Choosing Between Payment Aggregator vs Direct Payment Gateway

For experienced merchants, platforms, and fintech teams, the real question is not “Which provider is cheaper?” but “Which operating model best matches our scale, control needs, regulatory appetite, and roadmap for the next 3–5 years?”

The global payment gateway market is projected to reach well over USD 80–90 billion before 2030, while the payment aggregator market is expected to grow from roughly USD 7 billion in 2026 to several times that by 2035, driven by wallets, SMB digitisation, and A2A rails.

This decision directly impacts margins, authorization rates, resilience, and your ability to launch new products and corridors.

Core Models and Money Flows

Model Definitions

Direct Payment Gateway + Acquirers

- Gateway is the tech and routing layer between your checkout and one or more acquirers.

- You (or your PSP entity) hold your own MIDs with acquirers.

- You are the direct counterparty for pricing, settlement, and disputes.

Payment Aggregator (PA / PSP)

- Aggregator is a licensed/regulated funds‑flow entity.

- Holds pooled merchant accounts, onboards merchants under its umbrella.

- Offers one integration for cards, wallets, A2A, BNPL, etc., and manages escrow, settlement, and much of compliance.

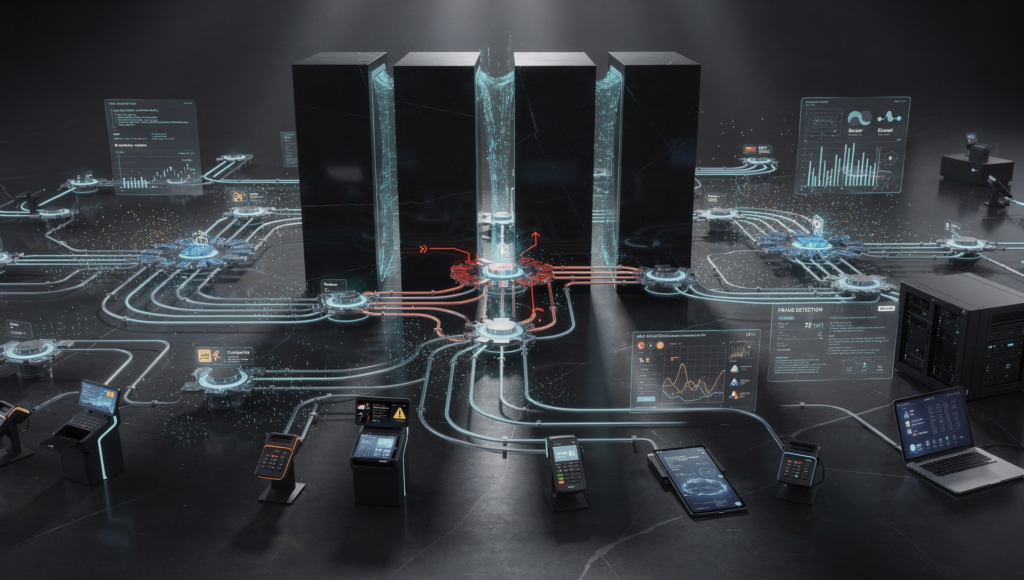

High-Level Flow View

| Step | Direct Gateway Model | Aggregator Model |

| Checkout | Merchant → Gateway | Merchant → Aggregator |

| Processing | Gateway → Acquirer(s) → Schemes → Issuer | Aggregator → Acquirer(s) / Schemes → Issuer |

| Merchant account | Merchant’s own MID(s) | Aggregator’s pooled MID(s) |

| Settlement | Acquirer ↔ Merchant | Acquirer ↔ Aggregator ↔ Merchant (via escrow) |

At-a-Glance Comparison for 2026

Operational and Economic View

| Dimension | Direct Gateway + Merchant Account | Payment Aggregator |

| Merchant account | Dedicated MID(s) with acquirer | Shared/pooled MIDs under aggregator |

| Onboarding speed | Weeks–months (bank underwriting & risk) | Days–weeks (aggregator KYC/KYB) |

| Integration effort | Per acquirer / per method | Single integration → many methods |

| Go-to-market | Slower, higher initial effort | Very fast, minimal bank ops |

| MDR / pricing | Lower at volume, negotiable | Higher blended MDR; margin to aggregator |

| Routing & UX control | High (multi-acquirer, issuer‑aware, tokenization) | Limited; routing controlled by aggregator |

| Compliance burden | You own PCI, scheme rules, chargeback strategy | Aggregator handles major payment compliance / PA rules |

| Best suited for | High-volume merchants, PSPs, regulated fintechs | SMEs, early-stage, fast pilots and new markets |

Read More About White Label Payment Gateway Development

2026 Market Signals You Should Care About

- Payment gateway markets are growing in low double‑digit CAGR, driven by cross‑border e‑commerce, instant rails, and embedded finance.

- Payment aggregators already power billions of customer accounts and are projected to grow >20% CAGR in many regions as SMBs and micro‑merchants digitise.

- Multi‑acquirer strategies are mainstream: data shows 1–3 percentage point auth uplifts and better fee leverage when merchants route intelligently across acquirers.

- Regulators (e.g., RBI PA Directions 2025) are tightening rules on capital, escrow, KYC/AML, and cyber controls, making “becoming a PA” a deliberate strategic move.

Cost, Time-to-Market, and Risk: The Decision Table

Setup and Economics

| Aspect | Aggregator | Direct Gateway + Acquirer |

| Time-to-launch | Days–weeks | Weeks–months |

| Upfront cost | Low (integration + minor config) | Higher (integration, PCI uplift, onboarding) |

| Per-transaction fees | Higher blended MDR (often 2.5–3.5%) | Lower at scale; individually negotiated |

| Dev/infra effort | Minimal to moderate | Moderate to high (or partner-supported) |

| Typical break-even | Often around USD 0.5–1M annual card TPV | Attractive once beyond that range |

Read More About White Label Payment Aggregator Development

Risk and Compliance Allocation

| Dimension | Aggregator Model | Direct Gateway Model |

| PCI scope | Slimmer for merchant | Broader; you run PCI-aligned infra |

| Chargebacks/risk | Aggregator drives policy; you follow | You and acquirer own/share risk strategy |

| PA / PSP licence | Aggregator holds licence | Optional; you may remain a tech provider |

| Funds / escrow | Aggregator manages escrow & settlement timings | Acquirers settle directly to you |

Practical Heuristics: Which Model Fits You Today?

Use a Payment Aggregator If…

- You need fastest possible go‑live in a new product/market.

- Your current annual card TPV is below ~USD 0.5–2M, depending on geography and mix.

- Payments are enabling infrastructure, not your core differentiator.

- You do not yet have dedicated payments/risk/compliance capacity.

You are optimizing for speed and simplicity, accepting higher blended costs and less control.

Use Direct Gateway + Acquirer If…

- You are already at, or expect soon to be at, multi‑million annual TPV.

- Margins are sensitive to 20–40 bps swings in fees and auth.

- You want granular control over routing, tokenization, retries, issuer strategies.

- You are ready for, or already have, payments engineering and compliance muscle.

You are optimizing for unit economics, control, and long‑term defensibility.

Product and Technical Trade-offs

Direct Gateway + Multi-Acquirer: Where It Wins

- Multi-acquirer routing

- Route by BIN, issuer, geography, card type, merchant segment, and risk scores.

- Independent analyses and provider data show 1–3% auth uplift and MDR optimization with multi‑acquirer strategies.

- Deeper UX and risk control

- Custom checkout flows, dynamic 3DS/SCA, risk-based flows, network tokenization, and advanced retry logic.

- Data ownership

- Full visibility into decline codes, issuer behaviour, cohort performance, and lifetime value by rail and acquirer.

Aggregator-Led: Where It Wins

- One integration, many methods

- Cards + UPI/A2A + wallets + BNPL + netbanking out of the box.

- Operational simplicity

- Aggregator handles PA duties, settlement rules, disputes framework, and many regulatory updates.

- Low barrier experiments

- Easy to test new countries, segments, or product features without dedicated infra projects.

Regulatory and Geo Nuance

India example: RBI’s Master Directions for Payment Aggregators consolidate requirements on net worth, escrow, merchant KYC, and cyber resilience for online and physical PAs.

- Broader trend: APAC, MENA, and LatAm regulators are separating regulated PSP/PA roles from pure tech roles, with defined capital and operational expectations for entities that hold or route customer funds.

If you plan to:

- Hold settlement funds or float.

- Act as merchant of record for many downstream merchants.

- Offer wallet‑like or custodial balances.

Migration and Hybrid Paths

- Phase 1 — Aggregator-first

- Use 1–2 aggregators to get to market quickly and validate corridors and product.

- Phase 2 — Add direct acquiring via gateway

- Add acquirers for top corridors and route a portion of volume via your own gateway to measure auth and fee impact.

- Phase 3 — Hybrid steady state

- Direct routes for high‑volume flows and key merchants.

- Aggregators for long‑tail countries, niche methods, and backup/failover.

- Phase 4 — Internal PSP/PA platform (optional)

- Build or adopt a white‑label PSP/aggregator stack: sub‑merchant onboarding, flexible pricing, settlement/ledger, and orchestrated connectors to both acquirers and external aggregators.

This hybrid model is usually where most value is realized: speed + coverage from aggregators, plus control + economics from direct routes.

How PrimeFin Labs De-risks and Accelerates These Decisions?

Your real problem is not “aggregator or gateway?” It is: “How do we move from where we are now to the model we need next without a multi‑year replatforming gamble?”

That is exactly the gap PrimeFin Labs is built to close.

What PrimeFin Labs Provides?

- API-first, acquirer-agnostic gateway & orchestration core

- Multi‑acquirer routing engine with rules by BIN, issuer, region, method, merchant segment.

- 3DS/SCA orchestration, token vaults, hooks for external fraud/risk engines.

- Aggregator / PSP capabilities on the same core

- Sub‑merchant onboarding (KYB), fee/commission models, split settlements, marketplace flows.

- Merchant and ops consoles for risk, disputes, settlement management.

- Ledger, settlement, and reconciliation

- Event‑driven, double‑entry ledger across all acquirers and aggregators.

- Automated reconciliation and exception handling for settlement files.

- Deployment & ownership choices

- Cloud, hybrid, or on‑prem with source‑code delivery, so you are not locked into a black‑box SaaS stack.

Citation

- Payment gateway vs payment aggregator roles, go‑to‑market speed, MDR differences, and typical merchant profiles

https://worldline.com/en-in/home/main-navigation/resources/blogs/2024/payment-gateway-vs-payment-aggregator - Technical and product distinctions, including routing control, auth optimization, and when direct acquiring makes sense

https://juspay.io/en-in/blog/understanding-payment-gateway-vs-payment-aggregator - Market growth of payment aggregators, CAGR projections, and SMB/micro‑merchant digitisation data

https://coinlaw.io/payment-aggregator-statistics/

- Regulatory and licensing perspective on payment aggregators (capital, escrow, KYC/AML, RBI PA Directions 2025) https://www.fidcindia.org.in/wp-content/uploads/2025/09/RBI-PAYMENT-AGGREGATORS-DIRECTIONS-15-09-25.pdf