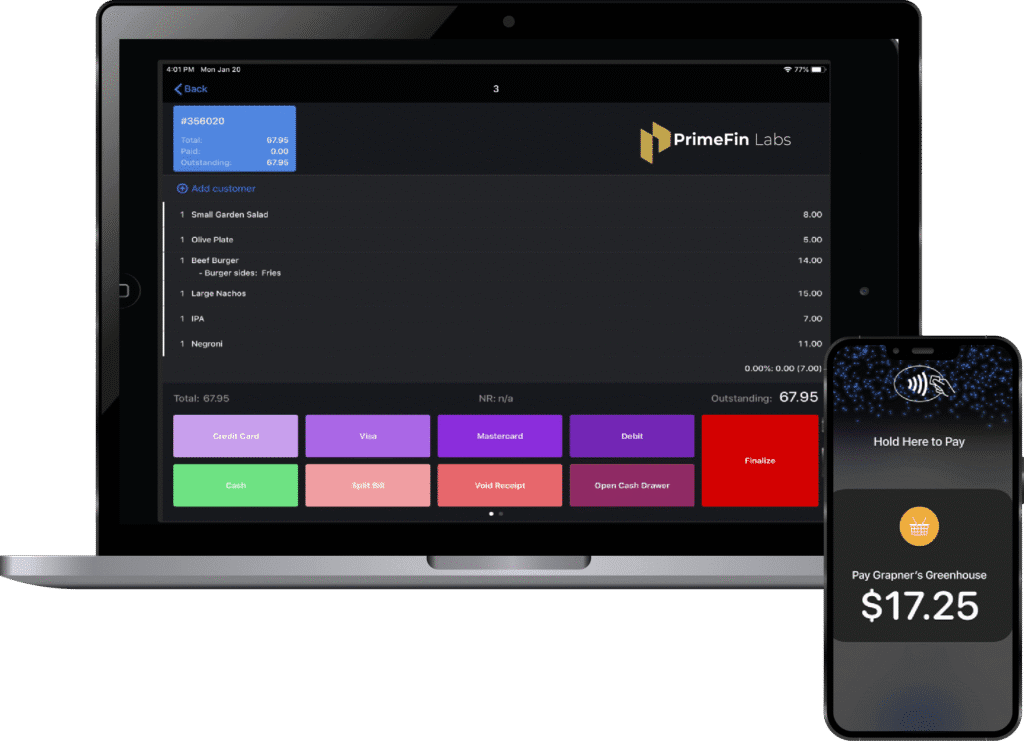

Payment Aggregator Software Development

Launch a secure, scalable payment aggregation platform with merchant onboarding, acquirer routing, transaction orchestration, and real-time settlement — built for fintechs, PSPs, and embedded platforms.

What We Build?

Merchant Onboarding Engine

API-based onboarding with document upload, business validation, KYB, and tiering logic

Transaction Switch

Real-time routing to acquirers with fallback, retries, velocity checks, and override rules

Acquirer Integrations

ISO 8583, REST, XML-ready modules with multi-acquirer support and dynamic routing rules

Refund Handling

Dispute workflows with evidence uploads, status tracking, and merchant visibility

Reconciliation Engine

Match acquirer reports with transaction logs and merchant ledger entries

Merchant Portal

Payout reports, webhook logs, balance snapshots, dispute status, and analytics

Platform Capabilities

API-First Architecture

REST APIs, event webhooks, and token-secured endpoints for merchant, acquirer, and admin interfaces

Dynamic Routing Engine

REST APIs, event webhooks, and token-secured endpoints for merchant, acquirer, and admin interfaces

Tokenization Vault

Store cards securely with PCI-DSS certified encryption and token mapping

Refunds & Chargebacks

Manage dispute flows and full/partial refund triggers through UI or API

Risk Filters

Transaction velocity, MCC checks, blacklist, and dynamic rule engine integration

Smart Fees Engine

Define tiered pricing, split commissions, and custom fee logic per merchant or transaction type

Admin Console & Ops Tools

- Merchant onboarding approvals and KYB tier mapping

- Transaction flow overview: acquirer status, retry, latency

- Real-time refund & dispute tracking

- Balance and settlement status per merchant or group

- API logs, webhook retry queues, and delivery status

- Role-based access for compliance, support, ops, and tech

Built for Scale & Control

From high-volume transaction orchestration to acquirer-level logic and merchant-level ledgers — our platform architecture is engineered for scale, resilience, and fine-tuned operational control across geographies.

- Acquirer switching by country, merchant type, or fee bracket

- Embedded settlement trigger engine

- General ledger with double-entry accounting per merchant

- Pre-integrated support for cards, netbanking, UPI, wallets, and more

- Horizontal scaling with stateless microservices

- Ledger rebuild + failover recovery tools

Use Cases

Designed to serve fintechs, platforms, and aggregators across industries — our modular stack adapts to your vertical, payment flow, and compliance needs without rebuilding from scratch.

Why PrimeFin Labs?

Fintech Domain Expertise

Over a decade building secure, high-scale PSP and aggregator stacks

Global-First Stack

Region-neutral platform design, regulation-agnostic logic built-in

Modular Architecture

Plug-and-play switch, ledger, onboarding, and tokenization modules

Fast MVPs

First build in 4–6 weeks; scalable rollout in 8–12 weeks

Tech Partner Support

Swagger, Postman, sandbox keys, and prebuilt test payloads

Infrastructure Grade

Microservices, observability, and fault tolerance from day one