Payout & Reconciliation Mechanism Software Development

Automate disbursals, control payout logic, and close your books faster with custom-built, API-first infrastructure — built for scalability, compliance, and fund accuracy.

What We Build?

Merchant Disbursements

Mass payouts with FX, TDS, invoice mapping & fallback routing.

Platform Commissions

Split & settle revenue across partners, vendors, and operators.

Contractor & Gig Payouts

Flexible one-time or milestone-based payout orchestration.

Cross-Border Remittances

Automated routing, conversion, and compliance-ready fund flow.

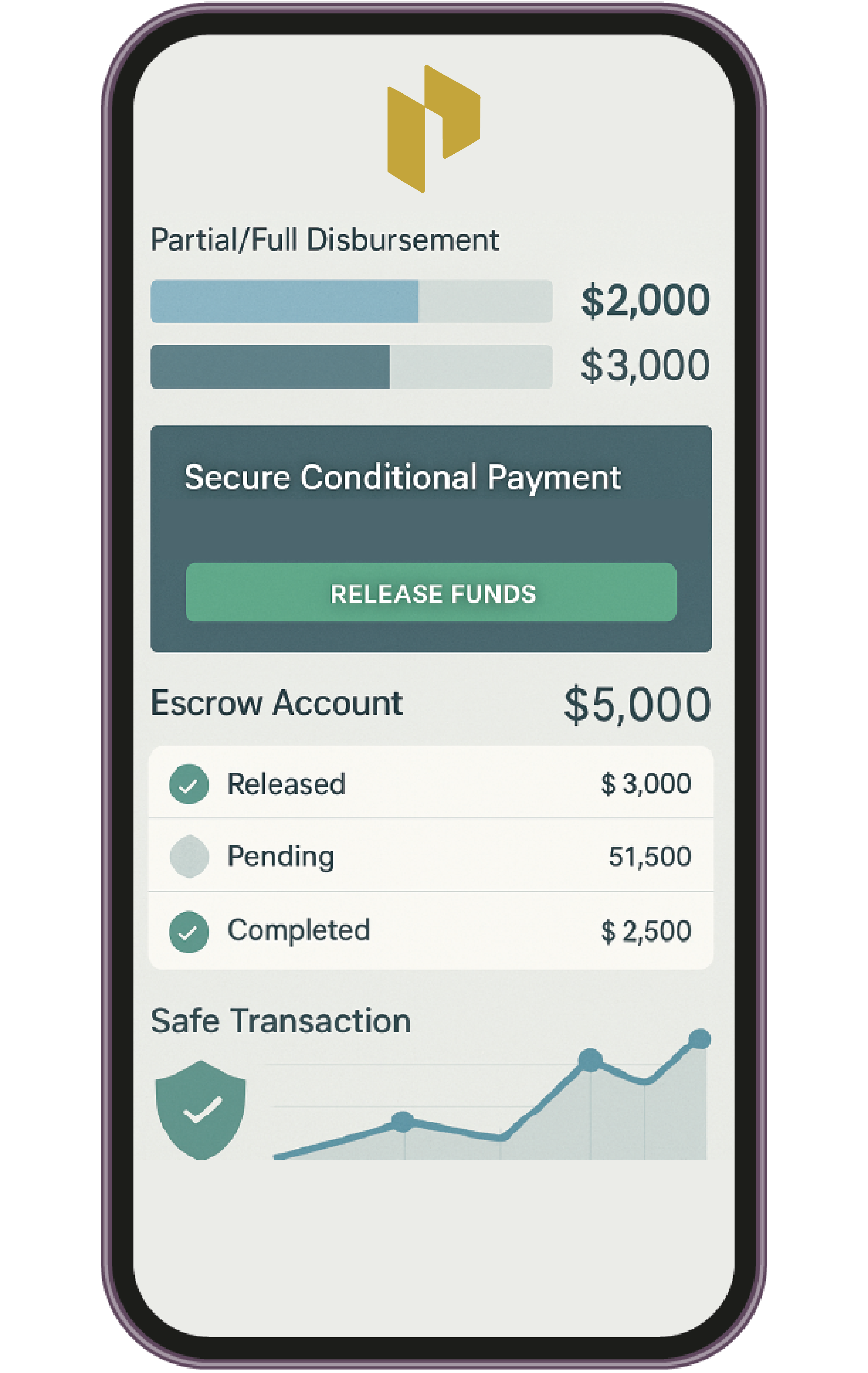

Escrow Releases

Condition-based partial/full disbursement handling.

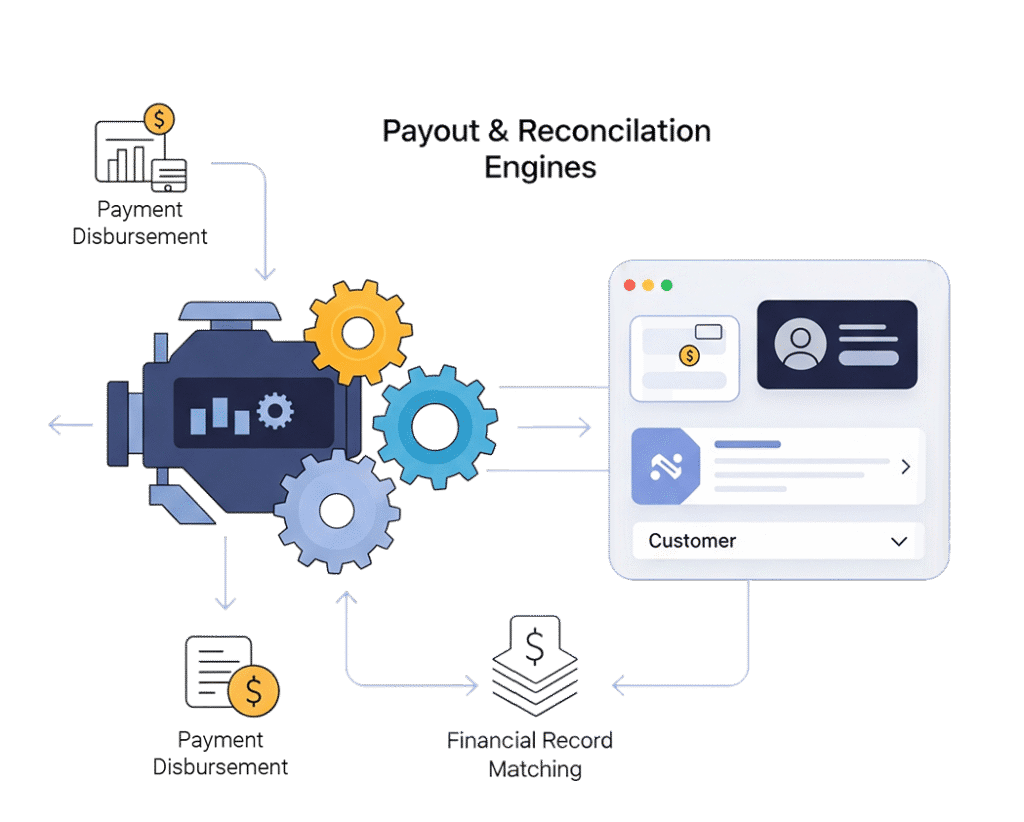

Transaction Matching

Real-time 1:1 or 1:N recon across banks, PGs, and ledgers.

Bank File Parsing

Support for MT940, CAMT, XLS, and API-based reconciliation.

Revenue Accounting

Sync to ERP or GL with accurate income attribution.

Dispute Resolution

Handle exceptions with approval routing and tagging.

Audit & Compliance Logs

Export-ready reports for tax teams and regulatory filings.

Core Capabilities – Payout Layer

We develop granular control layers with configurable approval workflows, maker-checker flows, and role-based access controls.

Set transaction-level limits by user, region, or entity. Risk flags, exception tagging, and audit logs are built-in for compliance-sensitive operations

- Scheduled & on-demand payouts

- Rule-based partner/merchant disbursement logic

- Multi-leg routing & fallback retries

Enable payouts in 50+ currencies with FX conversion logic, mid-rate markups, and buffer handling.

Our engine supports local bank disbursements, SEPA, SWIFT, wallet-based payouts, and cross-border card pushes — all with automatic currency detection and ledger adjustment.

- FX-ready disbursals with conversion logic

- Bank, card, wallet, and UPI payout rails

Enable payouts in 50+ currencies with FX conversion logic, mid-rate markups, and buffer handling.

Our engine supports local bank disbursements, SEPA, SWIFT, wallet-based payouts, and cross-border card pushes — all with automatic currency detection and ledger adjustment.

- Multi-approval workflows

- Role-based limits & audit trails

- Configurable risk flags

Core Capabilities – Reconciliation Engine

We combine precision-led engineering with automation to deliver a fault-tolerant reconciliation engine, built to verify every transaction and settlement with confidence.

Embedded Monitoring & Ops Console

Track payouts, spot anomalies, and manage user roles — all from a unified console built for ops, finance, and compliance teams.

Developer-First System Architecture

Our wallet infrastructure is designed for resilience, auditability, and developer velocity — modular, scalable, and fintech-grade.

API Gateway

Unified entry point with token-based access and rate-limiting for secure external integrations.

Event Queues

Real-time event stream for transaction state, retries, webhook dispatch, and observability.

Payout Microservices

Isolated microservices for disbursals, splits, scheduling, and retries — horizontally scalable.

Ledger Engine

Double-entry abstraction with audit trails, currency separation, and reconciliation hooks.

Sandbox + CI/CD

Test-ready environment with role-based keys, versioned API sets, and seamless deployment pipelines.

Embedded Monitoring & Ops Console

Live Payout Tracker

View initiated, pending, completed batches

Anomaly Detection

Monitor velocity, disbursal patterns, duplicates

Ops Reports

Filterable by entity, channel, transaction type

Compliance Logs

Export audit trail with user actions & approval layers

Role Permissions

Multi-department access (ops, finance, tech)

Use Cases

We help PSPs launch secure, acquirer-agnostic EMV and SoftPOS stacks — complete with merchant-configurable flows, dynamic host routing, and remote terminal management tools.

Our software layers are optimized for multi-merchant support, fast integration, and real-time reporting.

For marketplaces handling suppliers, vendors, or agents, we develop logic-based fund distribution layers. Automate payment splits, commission holds, and milestone-based release workflows.

Sync directly with your ERP or invoicing system and reconcile at line-item level.

Region-specific onboarding integrations with Trulioo, Sumsub, IDNow, and others. Features include document OCR (MRZ, selfie, proof of address), liveness detection, video KYC, sanctions screening, adverse media checks, and politically exposed person (PEP) classification.

We support AML transaction monitoring rules, case management workflows, and audit logging for compliance teams.

Connect seamlessly with QuickBooks, Xero, NetSuite, SAP, and other ERP suites. Map transactions to general ledger accounts, automate settlement reconciliation, and generate real-time P&L summaries.

Custom chart-of-accounts mapping, tax code syncing, invoice batching, and financial period locking supported via API or SFTP-based data exchange.

Why PrimeFin Labs?

Fintech Focus

10+ years building wallets, gateways, and payout systems

White-Label

Launch branded platforms with pre-built modules

Modular by Default

Integrate payout, ledger, or reconciliation separately

Global Compliance-Ready

PCI, SOC2, GDPR, regional laws

Purpose-Built Architecture

Not repurposed accounting tools

Proven at Scale

Designed for high-volume, multi-entity operations