Remittance Software Development

Launch secure, multi-corridor money transfer platforms with full agent control, real-time payout integrations, KYC automation, and compliance-first architecture — built for scale, speed, and trust.

What We Build?

Agent Portal

Multi-role dashboards for send/receive agents, onboarding, commissions, and float tracking

Sender App/Web UI

Currency conversion, routing logic, and fee breakdown with real-time ledger entries

Payout Integrations

APIs for bank transfers, mobile wallets, and cash pickup providers

Payout Integrations

APIs for bank transfers, mobile wallets, and cash pickup providers

Compliance Layer

Region-specific KYC/AML, transaction limits, and sanction screening

Audit & Reconciliation

Match agent float, wallet debit, and beneficiary payout for every transaction

Core Platform Capabilities

Designed for high-volume, cross-border money transfers, our remittance engine ensures instant or scheduled fund transfers, complete with real-time foreign exchange conversion and fee breakdowns.

With multi-rail support including SWIFT, UPI, and mobile money, we enable seamless, global transaction flows.

- Role-based dashboards with live metrics

- Automated reconciliation & exception logs

- AML alerts & velocity rules per corridor

- Audit-ready exports & regulator reporting

Our platform simplifies the sender and beneficiary experience with easy-to-use, multi-language portals.

From ID verification to real-time status updates via SMS/email, our solution ensures secure, compliant, and transparent transaction management for both senders and recipients.

- Instant or scheduled fund transfers

- FX conversion with real-time rates

- Transaction-level fee & margin logic

- Multi-rail support: SWIFT, UPI, mobile money

Equip your operations and compliance teams with real-time transaction tracking, automated reconciliation, and exception handling.

Our platform offers role-based dashboards, AML alerts, and audit-ready exportable reports to ensure smooth, compliant, and efficient operations across all levels of your business.

- Role-based dashboards with live metrics

- Automated reconciliation & exception logs

- AML alerts & velocity rules per corridor

- Audit-ready exports & regulator reporting

Solving Industry Challenges

Agents rely on Excel and WhatsApp for tracking

Slow or delayed payouts hurting user trust

Peak-hour KYC queues causing user friction

Manual ledgers lead to payout mismatches

Long delays in regulatory approvals

Existing platforms struggle to scaley

Unified web portal for secure, trackable agent operations

Real-time payout integrations with fallback routing

Automated eKYC and biometric onboarding, with approval workflows

General ledger engine + auto-reconciliation module

Region-ready architecture: RBI, FCA, NIBSS, MAS, etc.

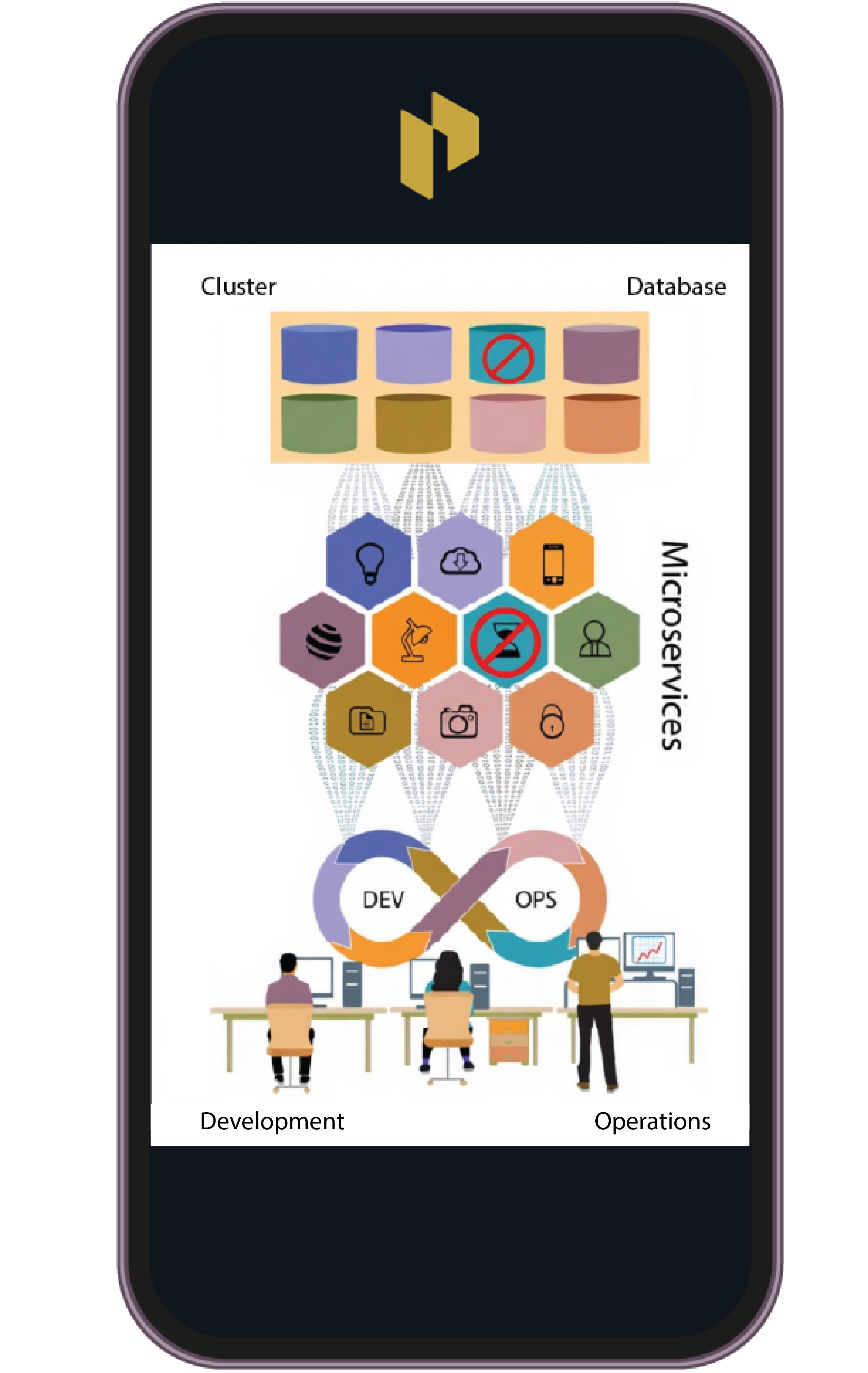

Microservices-based platform with horizontal scaling support

System Architecture Snapshot

A high-performance backend flow — engineered for concurrency, transparency, and secure transaction orchestration.

Console Capabilities

Our award-winning designs underscore our ability to deliver results that consistently delight our clients.

-

Live Transfer Monitoring (by corridor, status, and beneficiary country)

-

Compliance Triggers (KYC pending, AML match, velocity breach)

-

Float Balance & Agent Commission Reports

-

Exportable Transfer & Audit Logs

-

Ops Alerts & Approval Workflow

-

Multi-user access: agent, finance, compliance, admin

Use Cases

From agent-led networks to digital-first platforms, our remittance engine adapts to the operational, compliance, and technical needs of today’s money movement businesses.

Why PrimeFin Labs?

Fast Time-to-Market

MVPs in 4–6 weeks, scalable rollouts thereafter

Modular Architecture

Choose only what your use case needs — integrate or replace later

Global-Ready Codebase

Built for multi-currency, multi-country, and local regulation

Developer Support

Swagger docs, Postman collections, test payloads, and direct support

Domain-Specific Expertise

10+ years in money movement, wallets, FX, and fintech compliance

White-Label

Launch branded platforms with pre-built modules — fully customizable, with your business model